Credit card as a service. 2021 q3 additional digital credit card online campaign;

Cash Back Credit Cards - Rbc Royal Bank

Upon approval, add it to your digital wallet, and begin using within minutes.

First digital credit card cash advance. You can ask your teller for a cash advance with your credit card. The first digital mastercard cash advance limit is half of the cards credit limit. You can request a new one.

Click here to request for a cash advance pin. First progress platinum mastercard secured credit cards are issued by synovus bank, columbus, ga, member fdic. In addition to the periodic interest charge we assess on cash advances, each time you obtain a cash advance, we will impose a transaction fee as specified in the accompanying summary of terms, and such fee is included in your daily balance for cash advances for the purpose of calculating interest.

Select the cash advance option on. Can you get a first savings credit card cash advance? For example, if your credit limit is $15,000 and the card caps your cash advance limit at 30%, your maximum cash advance will be $4,500.

This means you'll be charged a cash advance fee (usually 3% to. It usually takes several days for your pin to arrive in the mail,. You could pay as much as 5% of the balance, and that balance will accrue interest at a faster rate than your purchases.

However finance charges still apply. Malaysias first carbonneutral credit card. You can insert your card, enter your pin and receive your cash.

You'll need to present your physical card at the bank, and they will likely request identification from you as well to confirm the card is yours. Please read your cardholder agreement (included with your new card upon approval) for more information on cash advances. Upon approval, add it to your digital wallet, and begin using within minutes.

The cash advance transaction fee is $10 or 3% of each cash advance, whichever is greater important disclosures. A 3% fee of the amount with a $10 minimum, with the disney credit cards. You can withdraw additional cash at atms with zero cash advance fees.

Youll just need to provide a government issued photo id like a driver's license along with your capital one card. In addition to the interest charge on cash advances, there is a fee of 5% or $5.00, whichever is greater, for each cash advance posted to your account that month (cash advance fee). Chase comes with one of the highest cash advance fees and interest rates.

To get a first access visa credit card cash advance: The destiny mastercard is an unsecured card that offers consumers with an imperfect credit history a way to rebuild and access a small line of credit. Click here to provide your credit card delivery details.

Many credit cards allow you to withdraw some portion of your credit line as cash (from an atm, for example), but youll pay for the privilege. Each check may be used only by the person(s) whose name(s) is/are printed on it. Cash advances incur transaction fees and high interest rates typically with no grace period that make them prohibitively expensive for cardholders.

How to get a cash advance if you dont have your pin. If youve been given checks by your credit card issuer, you can fill one out to yourself. Insert the credit card at an atm and enter the pin.

$10 or 3% of the cash advance amount, whichever is greater: Any unpaid cash advance transaction fee interest charges will be added to the calculation of your average daily balance of cash advances. Simply provide the required information in the given fields.

Depending on your card, you will pay: Keep in mind that cash advances are not subject to a grace period, so daily interest starts accruing immediately. Adding insult to injury, cash advances dont count as qualifying purchases, so.

Cash advances are typically capped at a percentage of your card's credit limit. You can take a cash advance inside a bank lobby that displays the visa or mastercard credit card logo. The cash advance fee is a finance charge.

You can get a cash advance from a credit card by using an atm with your pin or visiting a bank and requesting a cash advance. The average cash advance apr is 25.99% but it could vary between cards. Those that do allow you to buy crypto with your card will likely consider it to be a cash advance.

A cash advance transaction fee interest charge imposed on each cash advance transaction posted during a billing cycle, in an amount equal to the greater of $5 or 5% of the amount of each cash advance. If you're a sofi customer, you can redeem your rewards toward investing. What is the maximum you can withdraw through a credit card cash advance?

No cash advances are permitted during the first 95 days an account is open. The cash advance apr is 35.99%, and the fee for each transaction is $10 or 3% of the advance amount, whichever is greater. Youll get a credit limit of $300, but you wont get any rewards, benefits, or perks.

What are the costs associated with credit card cash advances? A 5% fee of the amount with a $10 minimum. Enroll to bdo auto charge for automatic payment of your monthly bills.

Checks will not be subject to any stop payment order and will not be returned to you. Yes, you can, but cash advances are almost never a good idea. For cash advance transactions and website enrollment of your credit cards.

A cash advance is the use your card or a check (which you sign as drawer, like a personal check) to obtain cash loans from any financial institution that accepts the card. Once approved, you may call and request a personal identification number (pin) to be sent to you in the mail;

:max_bytes(150000):strip_icc()/dotdash_Final_8_Alternatives_to_a_Credit_Card_Cash_Advance_Oct_2020-01-9a2637fa582a4a2687ce65a99f556410.jpg)

8 Alternatives To A Credit Card Cash Advance

Bpi Blue Mastercard Bpi

What Is A Cash Advance On A Credit Card Credit Karma

Cash Advance Credit Cards Cash Withdrawals Comparethemarketcom

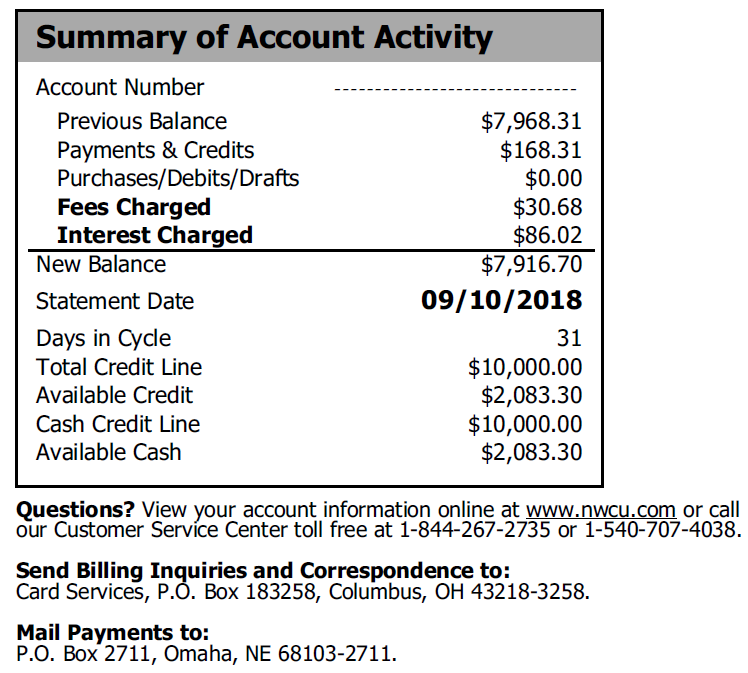

How To Read Your Credit Card Statement Nwcu

How Can I Get A Credit One Bank Credit Card Pin

Fit Mastercard Credit Card Reviews Is It Worth It 2021

Cash Advance Pengertian Dan Keuntungannya Bagi Pebisnis Paperid Blog

5 Best Cash Advance Credit Cards How To Get One - Cardratescom

Cool Walmart Family Mobile Payment Number Mobile Payments Mobile Banking Phone

5 Best Cash Advance Credit Cards How To Get One - Cardratescom

How To Get A Cash Advance On A Credit Card Without A Pin

Citi Custom Cash Card - Cash Back Credit Card Citicom

What Is A Cash Advance Fee And How Does It Work Credit Karma

8 Alternatives To A Credit Card Cash Advance

What Is A Cash Advance On A Credit Card Credit Karma

Credit Card Charges Hdfc Bank Credit Card Fees And Charges

What Is A Credit Card Cash Advance - Nerdwallet

What Is A Cash Advance And Should You Get One Forbes Advisor

First Digital Credit Card Cash Advance. There are any First Digital Credit Card Cash Advance in here.